This article is reproduced with permission from Spidell Publishing, Inc.

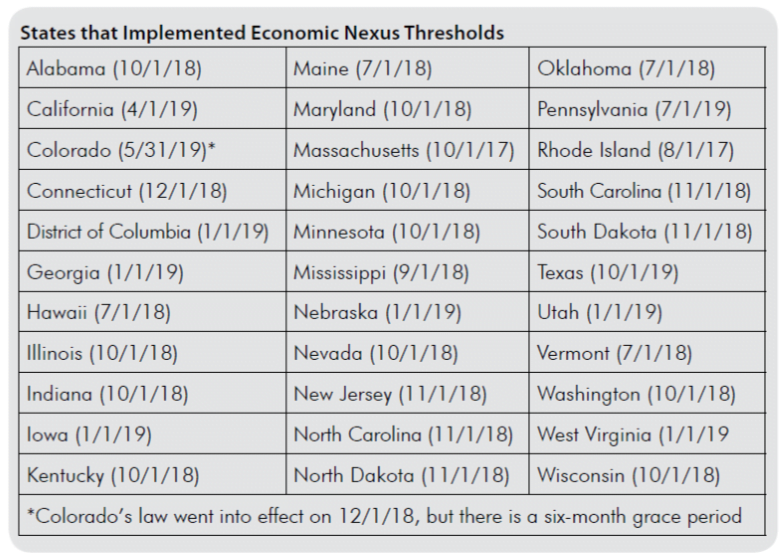

More than 30 states have quickly jumped on the Wayfair bandwagon and adopted some form of sales and use tax economic nexus thresholds through statute, regulations, or policy announcements. California will begin imposing an economic nexus threshold beginning April 1, 2019.

Below is a list of states that have adopted sales and use tax economic nexus thresholds and the date their laws went into effect.

For more detailed information as to each state’s economic nexus thresholds and registration/reporting requirements, see the 50-state Wayfair chart at:

https://www.caltax.com/spidellweb/public/editorial/CAT/0818CAT-nexuschart.pdf.

Many of the states not listed in the table above have economic nexus legislation pending in their legislatures.

Voluntary Disclosure Programs

Due to the speed with which many of the states listed above implemented the new economic nexus laws, it was not possible for many of taxpayers to come into immediate compliance. Taxpayers may want to consider either filing for reasonable cause penalty abatements or applying for relief through a state’s voluntary disclosure programs.

For more information about this article, please contact our tax professionals at taxalerts@windes.com or toll free at 844.4WINDES.

Learn more about our Tax & Accounting Services practice