At a Glance

Main Takeaway

The Current Expected Credit Loss (CECL) model is a newer accounting standard that requires companies to estimate and account for expected losses on their financial statements. It replaces the “incurred loss model,” providing a more forward-looking approach to credit risk management.

It does not only apply to financial institutions and can impact the financial statements of commercial companies and nonprofits required to recognize lifetime expected losses on a range of financial assets. The losses are based on supportable forecasts, in addition to past events and current conditions.

Next Step

The CECL model has significant implications for CFOs, executives, and business owners, requiring more comprehensive data, analysis, and reporting. Understanding the new accounting standard is crucial for implementing and ensuring compliance with generally accepted accounting principles.

What is CECL?

CECL, or Current Expected Credit Loss, is an accounting standard introduced by the Financial Accounting Standards Board (FASB) in Accounting Standards Update (ASU) 2016-13 that requires entities to measure credit losses on most financial assets carried at amortized cost and certain other instruments using this new model.

Unlike the incurred loss model, CECL requires entities to estimate credit losses over the entire contractual term of the instrument. Entities record the initial measurement of expected credit losses and any subsequent change in the estimate of expected credit losses as a credit loss expense or reversal in the current period income statement.

The primary objective of the CECL model is to provide financial statement users with an estimate of the net amount that the entity expects to collect on those assets. This more comprehensive and time-based approach enables organizations to identify potential risks early, facilitating better risk management and fostering financial stability.

When Did the Current CECL Model Go into Effect?

The FASB issued the current CECL model in June 2016 as part of the Accounting Standards Update (ASU) 2016-13 regarding credit losses under Topic 326. The implementation timeline for the CECL model was staggered, with different effective dates for various entities.

The CECL model was enacted on December 15, 2019, for public business entities that are SEC filers and their fiscal years starting on that date or later. For all other entities, such as nonprofit organizations, employee benefit plans, and private companies, the effective date for implementing the CECL model went into effect for any interim periods within their fiscal years that started after December 15, 2022.

How Does the Newest CECL Model Differ From the Former Impairment Model?

The Incurred Loss model recognized credit losses only when they were probable to happen, while the CECL model takes a more proactive approach by estimating expected credit losses for the entire lifespan of a financial instrument.

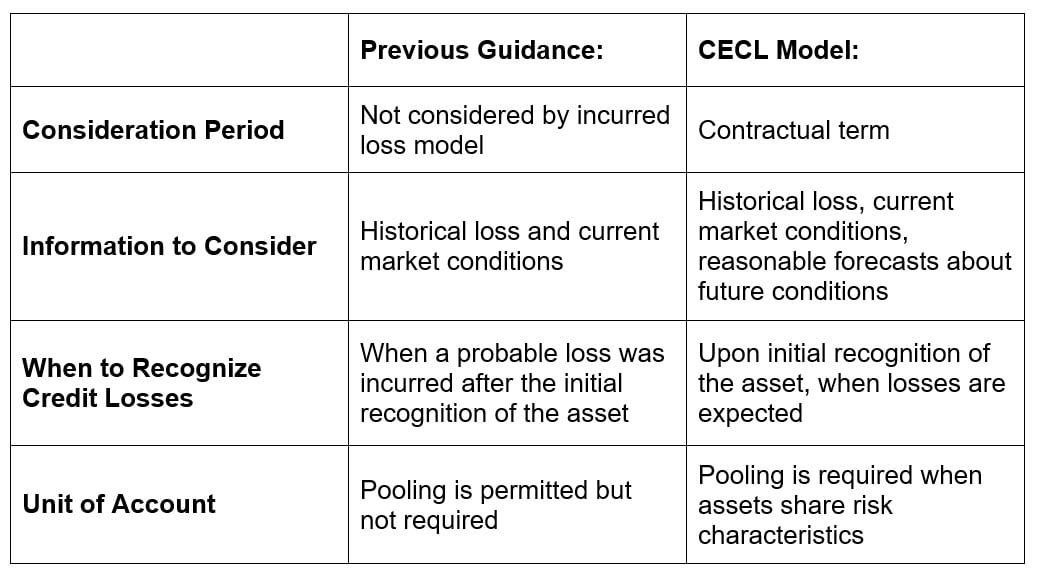

Differences between the two models include:

- Timing: The CECL model requires impacted businesses and financial institutions to recognize credit losses earlier than under the Incurred Loss model, creating a more comprehensive credit risk assessment, which forces organizations to better prepare for potential losses.

- Loss Estimation Methodology: While the Incurred Loss model relied on historical data and specific triggering events, the CECL model combines historical data, current conditions, and reasonable forecasts to estimate expected credit losses.

- Scope: The CECL model applies to a broader range of financial assets, including accounts receivable, loans receivable, debt securities, and lease receivables, offering a more holistic view of an organization’s credit exposure.

What Key Changes Did CECL Make to Previous Guidance?

The CECL model introduced several key changes to the previous guidance on measuring and reporting credit losses. These changes include:

What Disclosures Are Required Under CECL?

The CECL model introduces new disclosure requirements under ASC 326–20 to ensure greater transparency and a more comprehensive understanding of an organization’s credit risk exposure. These disclosures include the following:

- Credit Quality Indicators: Organizations are required to supply data for credit quality indicators, categorized by portfolio segment and notable risk characteristics.

- Reconciliation: A reconciliation of the beginning and ending balances for the allowance for credit losses, including information on charge-offs, recoveries, and any changes resulting from acquiring or disposing of financial assets.

- Credit Loss Estimation Methodology: A description of the organization’s methodology for estimating credit losses, including the factors considered, such as historical data, current conditions, and reasonable forecasts.

- Management’s Assumptions and Estimates: Disclosures must include management’s assumptions and estimates used in determining the allowance for credit losses and the rationale behind these assumptions.

- Past-Due Status: Information on financial assets that are past due, including the aging analysis of these assets.

How Does the CECL Impact Your Company’s Internal Financial Reporting?

Implementing the Current Expected Credit Loss (CECL) model has far-reaching implications for a company’s internal financial reporting. The shift from the Incurred Loss model to the more forward-looking CECL model affects various aspects of financial reporting, including:

- Data Collection and Management: CECL requires historical data, current conditions, reasonable forecasts, and a robust data management infrastructure. Companies must ensure they have the necessary systems and processes to collect, store, and analyze relevant data, which may entail additional investments in technology, human capital, and resources.

- Governance and Controls: Implementing the CECL model may require organizations to establish new governance structures and internal controls to ensure the consistent application of the model and adherence to disclosure requirements.

Partnering with Windes’ accounting professionals can help you revise and implement new risk management policies and procedures, credit loss estimation methodologies, and regular model validation processes under CECL guidelines.

- Communication and Training: As the CECL model represents a change in credit loss estimation, companies must ensure that all relevant personnel understands and can effectively apply the new model. This may involve extensive training and ongoing communication to ensure a smooth transition.

- Financial Planning and Analysis: Adopting the CECL model will impact financial planning and analysis processes, requiring organizations to incorporate expected credit losses into budgeting, forecasting, and strategic decision-making. Your company can implement CECL-based business strategies, risk appetite, and re-allocation of resources with the help of professional audit, review, and compilation services from Windes.

Embracing the CECL Model: Strengthening Financial Reporting and Risk Management

As businesses continue to navigate the complexities of the ever-evolving financial landscape, adopting the CECL model will be crucial in maintaining a competitive edge, safeguarding profitability, and ensuring the long-term financial health of their organizations.

Windes’ audit & assurance team offers industry expertise, guidance, and assistance with CECL model compliance. Our experienced professionals can help you implement the CECL model effectively, ensuring seamless integration with your existing financial reporting and risk management processes.

Let us be your trusted partner in strengthening your organization’s financial resilience and safeguarding long-term success. Reach out to Windes today and take the first step towards a proactive approach to credit loss estimation.