As we enter the last few months of the year, annual planning activities like creating budgets and forecasts become the focus for most leaders and finance teams. Budgets are drawn before starting any financial period, most commonly before the start of the fiscal or calendar year. While it requires a significant up-front effort with input from all departments, your budget is your roadmap for the year, setting the expectations for what the company needs to achieve and a way to keep all decision-makers on the same page.

With the budget in place, you can check how the company is doing compared to the plan over the course of the year. However, budgets are static and don’t consider variations like economic conditions, accounting errors, or any other deviations from the plan. That’s where variance analysis comes into play, and Windes Financial Planning & Analysis Services can help ensure you’re on target to hit your goals.

What is budget vs. actual?

Creating a budget is only half of the work—the other half lies in executing those plans.

A budget is simply the roadmap to your destination. Throughout the year and at important milestones, it tells you where you should be going. But achieving your goals requires getting in the car and driving to your destination.

Checking your progress is crucial; a valuable tool called variance analysis can help you do that. Variance analysis can be shown in several different forms, but one of the most useful is the budget vs. actual report.

As we mentioned, deviations from your budget will always occur—that’s life! But because they happen, it’s important to analyze why they happened and the extent of their effect on the business so you can be better informed in your planning moving forward. Your finance team should be regularly providing these essential reports along with insights on how your performance measures up against your goals. Ideally, budget vs. actual reports should be done monthly to improve budget accuracy and ensure your organization can quickly correct course.

Not getting these valuable reports? Windes skilled accounting professionals can assist your finance team with variance analysis reporting to keep you on course. Connect with us now to start getting the tools and strategic guidance to grow your business.

Components of budget vs. actual

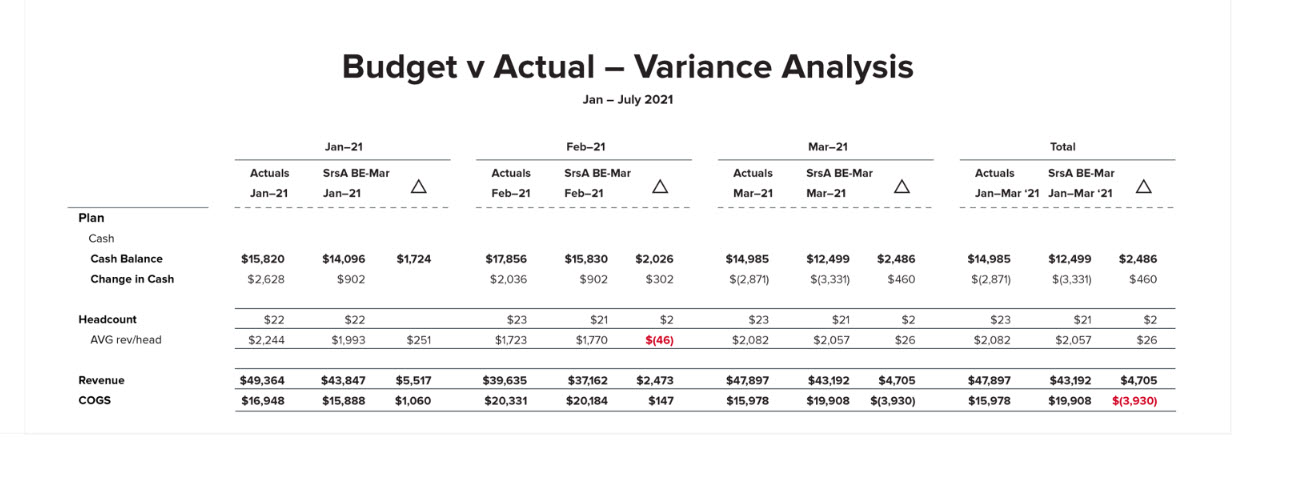

The budget vs. actual report compares how the company is performing against the defined budget figures over a fixed period. Gaps should be shown as absolute values and percentages, allowing easy targeting of the most significant problem areas – i.e., areas with the most value or percentage gaps.

For the analysis to be useful, you’ll need to see the major P&L blocks:

- Revenue (sales)

- Cost of goods sold

- Gross profit (or gross margin)

- Regular or operating expenses (grouped in functional sub-categories)

- Other expenses

- Net income

The layout will depend on your company structure and what’s critical to the business. However, cost and revenue blocks should be shown with enough granularity that you can start making decisions without needing to drill down each time.

For example, it might be helpful to look at both gross revenue and net revenue. If discounts are a necessity in your industry, clearly seeing their impact can help ensure the sales team isn’t giving away too much to get the sales. You would miss this valuable information by only showing one or the other.

Budget vs. actual analysis

Why is this analysis critical?

By creating a budget for the year, you’ve set the expectations for all company stakeholders. Over the year, nearly all aspects of the company can be measured against this baseline.

As such, the budget vs. actual analysis serves two primary purposes:

- It shows the management and the employees that the company is either performing well or some aspects need adjustment.

- Highlights which areas especially need focus.

Variance analysis

The real value of the budget vs. actual variance analysis comes from the resulting actions. The report should highlight areas that need attention—cost blocks with significant variations or KPIs not on target—and the team should define how to address those areas.

The best way to maintain a solid variance analysis is to set it up in your reporting system. This system should be robust enough to create a high-level macro view, yet also accommodate the need to drill down into the details.

Using the outcome of the analysis, the team can determine which actions need to be taken next.

Imagine that sales are much higher than the budget, but gross profit is stable, and net income is down due to higher-than-expected labor costs. Upon further investigation, you discover two issues:

- The gross profit impact is due to skyrocketing material costs from semiconductor shortages. The sales increase merely passes the higher material cost on to the customer.

- The labor variance is caused by personnel shortages. Some staff recently resigned, and the remainder work tons of overtime, including Saturdays and Sundays. Premium pay is keeping them motivated until additional staff can be hired.

Are you revisiting your goals? Are your KPIs missing their target? Windes can ensure you and your team focus on the right activities and help you define and measure your KPIs. Companies that revisit their goals quarterly see three times greater performance than those that don’t. Connect with us today to see how Windes can help your company stay on track to hit your target.

Tips and recommendations for analyzing budget vs. actual

Speed is key. The sooner you know you are missing your budget, the faster you can adjust. Your variance report should be available as soon as possible after a period is closed. Windes can link all your data sources to update your variance reports and charts automatically.

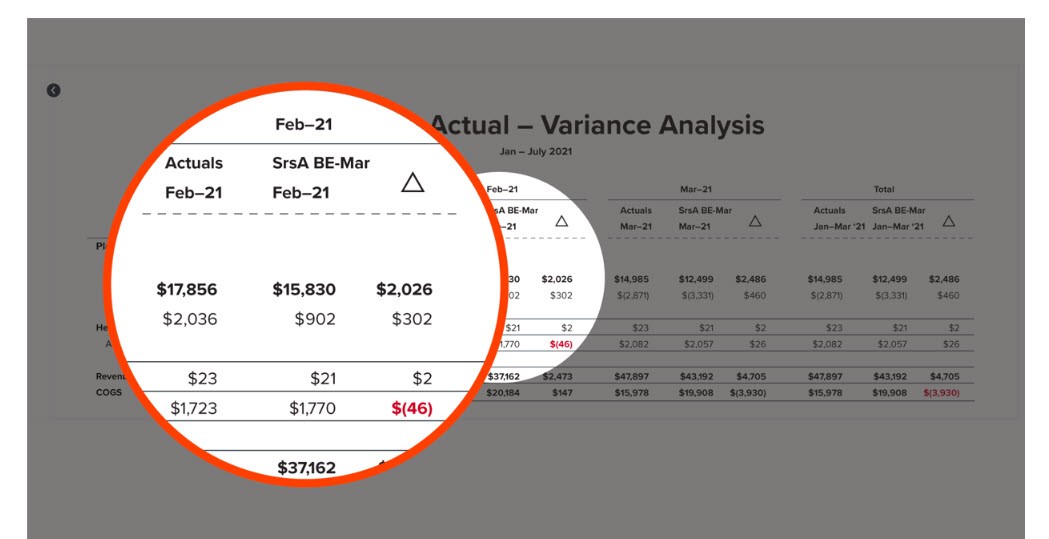

Visualizing your data can also help you and your team quickly recognize where the issues are. This speed in recognition allows for swift, decisive action.

Your variance analysis is the true link between your vision for the company and real-world reporting. Thus, it’s critical to have systems in place to provide this reporting efficiently.

Time spent compiling data and building spreadsheets is not a high-value-add activity. Windes Financial Planning and Analysis services can help your company work more efficiently and provide you with the information necessary to run your business. Your budget is your vision in action. Making the necessary link to reality is critical for strategic decision-making, and using a driver-based model that is easy to understand at a glance will yield the best results. Many of your KPIs will be dependent on non-financial metrics. These should also be included in your budget and can ensure you’re looking at the whole scope of the business.

Reports that complement budgets

Visual reporting, especially automated dashboards, can help you and your team better understand the analysis.

Beyond the budget, there are a few critical reports for owners and managers to monitor. These are especially powerful when looked at graphically and not simply spreadsheet tables.

- Cash flow statement: an overview of the business’s cash flows and position.

- Forecast: visualize where the company is headed. While it’s critical to understand your actual figures, controlling where you’re going is crucial.

- Key KPIs: a dashboard showing your most important key figures and metrics can give you an overview of the business at a glance.

Ready to see budget variance in real time?

Building a budget for your business is an excellent step towards building a successful company. You’ve created a roadmap for bringing the company to the next level, and now you need to execute that plan.

Keeping a close eye on the variances that inevitably pop up can help you ensure that bumps in the road aren’t going to throw you off track.

Windes is here to help transform your financial operations. From budgeting, analysis, forecasting, and reporting needs, our team of skilled accountants will assist you and your team with setting the expectations for what the company needs to achieve and provide variance analysis reports to make sure you’re on target to hit your goals.

Connect with us now and let our team of experts help you build your path to success today!