The big question when forming a new business entity in California is what type of entity should be formed. The decision often is between a California LLC vs. S Corp. This is because Limited Liability Companies (LLCs) and Subchapter S Corporations (S Corps) have consistently ranked as the top two options to be considered.

While LLCs and S Corps are both “pass-through” entities and provide liability protection, they also have several important differences. Owners need to consider profit-sharing, administrative requirements, LLC fees, state franchise taxes, employment tax implications, eligibility of owners, and operational ease when making their choice.

Business owners should consult with an experienced tax professional to weigh the differences between a California LLC vs. S Corp. The type of entity selected should meet the business owner’s needs, along with being able to handle any potential operational issues that their organization may encounter.What is in this article?

- LLCs Defined

- S Corps Defined

- The Advantages of LLCs

- The Downsides of LLCs

- The Advantages of S Corps

- The Downsides of S Corps

- Can you combine benefits for S Corps and LLCs?

- Filing in California for an LLC

- Filing in California for an S Corp

- Choosing a California LLC or S Corp

LLCs Defined

LLCs have default business structures similar to partnerships or sole proprietorships. The IRS states that LLCs are designed to give the same limited liability protections to its owners, similar to corporations, but LLCs also offer the operational flexibility and tax efficiency of partnerships. Since LLCs are pass-through entities, income and losses flow through to the owners and are reported directly on the owners’ tax returns. An important difference between LLCs and partnerships is the level of liability protection provided to its owners. Usually, the LLC member’s at-risk is limited to the amount invested in the LLC, plus any recourse liabilities assumed by the member. Conversely, general partnership members or sole proprietors hold liability for all the company’s debts – they do not shield themselves from tort actions, such as accidents. For these reasons, it is highly recommended that an experienced attorney be consulted.S Corps Defined

S Corps are corporations that have received an IRS designation of Subchapter S. Businesses must have a charter stating they are a corporation in the state where they have their headquarters. Next, they must file a valid S election to be treated as an S Corp. The IRS defines S Corps as unique entities that are apart and separate from their owners. As such, the owners have limited financial liabilities. In order to preserve the legal protection of the corporation, it is important not to commingle personal and corporate finances. S Corps differ from C Corps (traditional corporations) in that the S Corps’ income and losses pass through to the shareholders and are reported on the shareholders’ tax returns. This means that S Corps do not pay federal income tax at the entity level, unless certain taxes apply. Unlike business income earned by member-owners of an LLC, business income earned by S Corp shareholders is not subject to self-employment taxes. However, shareholders who actively work in the corporation are required to pay themselves reasonable compensation as W-2 wages. It is important to have the appropriate balance between required shareholder compensation and shareholder distributions of company profits, as there could be adverse tax implications for lack of compliance. S Corps are less flexible than LLCs as all items of income, loss, and distributions must be made on a pro-rata basis, according to ownership percentages. Failure to do so could jeopardize the S Corp status. [Back to Top]The Advantages of LLCs

A key feature distinguishing LLCs from S Corps is that businesses need fewer forms to register, which can reduce start-up costs. In addition, it is not necessary to hold formal shareholder meetings and maintain annual minutes for LLCs. LLCs provide more flexibility than S Corps. For S Corps, there are pro-rata requirements for items of income, loss, or distributions. Conversely, owners of LLCs may specially allocate income, loss, and distributions within the parameters of the tax law. The method of such allocations should be specifically described in the operating agreement, which is typically prepared by a qualified attorney. One additional advantage of LLCs over S Corps relates to a concept called tax basis. Tax basis is what allows taxpayers to deduct business losses and to take non-taxable profit distributions. LLC member-owners receive an increase in their tax basis for their share of qualifying debt in addition to equity. [Back to Top]The Downsides of LLCs

Although LLCs offer certain advantages, they are not perfect for every business. First, LLCs have limited lifespans. Usually, members need to decide on the duration of an LLC in advance, upon filing with the state. If there are plans to issue shares to employees or to take the company public, the LLC may be required to convert to a corporate business structure before doing so. Second, if the LLC members are active in the business, they can be subject to self-employment tax. This means that LLC members will have to pay the 15.3% self-employment tax, which includes Social Security and Medicare tax on their distributive share of the LLC’s net taxable income. [Back to Top]The Advantages of S Corps

The major difference that exists between a California S Corp and an LLC is the 1.5% S Corp tax and LLC fee. The 1.5% S Corp tax is based on the California net-taxable income, while the LLC fee is based on the California annual gross receipts. As an example, take a business with $150,000 net-taxable income and $3 million in gross receipts. As an LLC, it will have to pay an $800 annual minimum tax with a $6,000 LLC fee totaling $6,800. Meanwhile, an S Corp will only pay $2,250 of S Corp tax based on the 1.5% tax rate. Choosing to be an S Corp can provide tax savings to the owners for self-employment tax purposes. As explained previously, an active LLC member can be subject to self-employment tax on the distributive share of LLC income. Conversely, S Corp shareholders only pay payroll tax on the wages received from the S Corp as being its shareholder/employee. As stated above, shareholders shall receive reasonable compensation from the S Corp. If the shareholder receives a large amount of cash distributions while taking a very low salary, the IRS can challenge the shareholder’s compensation and reclassify the distributions as wages during an examination. S Corps exist independently from their shareholders. If one of the shareholders sells his or her shares, or dies, the S Corp continues doing business. Because the business is its own corporate entity, the lines between the business and its shareholders are clearer. This improves the protection shareholders enjoy. [Back to Top]The Downsides of S Corps

The solidity and tax savings of S Corps also come with some caveats. Since S Corps are separate structures, they require scheduled shareholder and director meetings. In addition to minutes being recorded from these meetings, other requirements include updates to bylaws, adoption, records maintenance, and stock transfers. Another issue is that not all states treat S Corps the same. Most states recognize them similarly without double taxation with the IRS. However, California, as an example, taxes S Corps at either 1.5% of its net income, or $800 (whichever is higher), which is in addition to the income tax that shareholders are required to pay on their share of the S Corp’s income. Another disadvantage of S Corps is that employees/shareholders will not be able to claim tax benefits on the business expenses they incurred. Because employees/shareholders are considered employees of the company, any unreimbursed business expense shall be treated as unreimbursed employee expenses, which are only tax-deductible for California income tax purposes subject to 2% of adjusted gross income (AGI). [Back to Top]Can you combine benefits for S Corps and LLCs?

Once an LLC is formed, it is possible to convert it to an S Corp by making an entity classification election. To make a timely filed election, Form 2553 must be filed within two months and 15 days from the effective date. From a legal standpoint, the LLC will remain a limited liability company. However, the IRS will treat it as an S Corp for taxation purposes. An S Corp, however, cannot be directly converted to an LLC. In order to change an S Corp to an LLC, you must first liquidate the S Corp, distribute all S Corp assets to shareholders, and then the shareholders must contribute the assets to a new LLC. Generally, this process can be costly from both the legal and accounting and tax perspectives. [Back to Top]Filing in California for an LLC

To form an LLC in California, you will need to register with the Secretary of State. The Secretary of State’s office defines the fees and rules. Below are seven steps to follow to complete the process.

- Select a business name

- Select a California registered agent

- Obtain state business permits

- File Articles of Organization

- The name of the LLC

- The address of the LLC’s California office

- Information about the LLC’s registered agent

- The management structure of the LLC (whether it is manager-managed or member-managed)

- The signature and nature of the organizer who is completing the form. Usually, but not always, this is one of the LLC’s members or managers.

- Domestic LLCs based in California and organized under state law have to complete Form LLC-1. Foreign LLCs formed under another state’s laws, but that wish to operate in California, need to complete Form LLC-5.

- Draft LLC operating agreements

- The LLC’s purpose, including the services or products it offers

- The addresses and names of all the LLC’s members

- Each member’s capital contributions

- The ownership interest of each member and allocation of the business profits or losses among the members

- The procedure for the admittance of new members

- The procedure for electing managers for manager-managed LLCs

- The procedures and schedule for meetings

- The dissolution procedure

- File Statements of Information

- Comply with tax obligations

- $800 annual franchise tax

- LLC fee based on the LLC’s California gross receipts

- Employer’s share of payroll taxes if the LLC has employees

- California individual income tax on each member’s distributive share of the LLC’s taxable income [Back to Top]

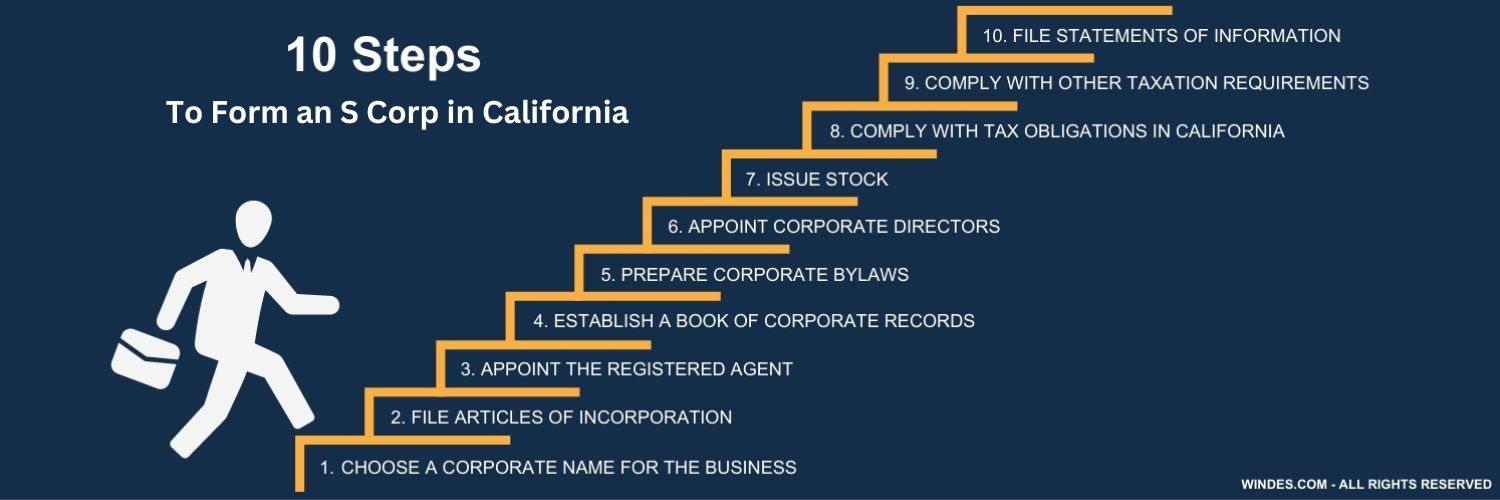

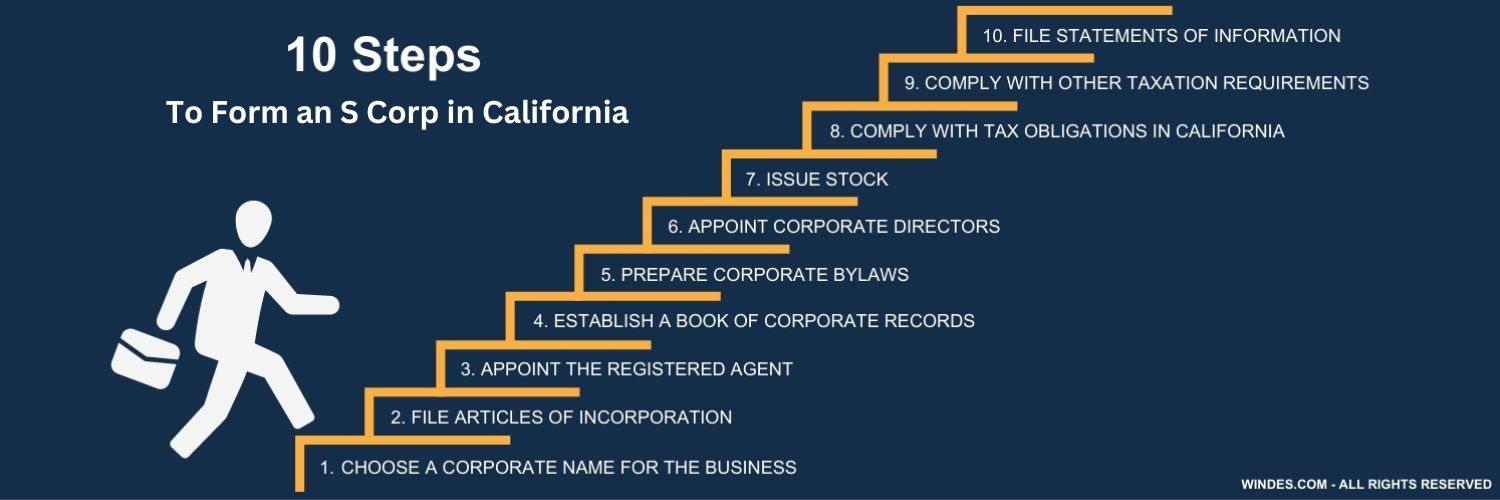

Filing in California for an S Corp

There are 10 steps to filing a business as an S Corp in the state of California.

- Choose a corporate name for the business

- File Articles of Incorporation

- the name of the corporation;

- the address of the corporation;

- the address and name of the S Corp’s registered agent; and

- the number of shares that the corporation can issue.

- Appoint the registered agent

- Establish a book of corporate records

- Prepare corporate bylaws

- Appoint corporate directors

- Issue Stock

- Comply with tax obligations in California

- Comply with other taxation requirements

- File Statements of Information