Now that the Tax Cuts and Jobs Act is in place, many Americans are left unsure as to what this means for their future tax liability. However, one thing is certain, many deductions individuals had become accustomed to are now gone. In California, with its very high cost of living, the tax benefits to homeowners are limited.

State and Local Tax Limitation

- Prior to tax reform, taxpayers had the ability to include a variety of different state and local tax payments in their itemized deductions. Now, state and local tax payments are limited to $10,000.

Mortgage Indebtedness Limitation

- Previously, interest incurred on a mortgage up to $1 million and interest on a $100,000 home equity line of credit was deductible. For new loans initiated after December 15, 2017, taxpayers are limited to deducting interest on a mortgage no greater than $750,000. Interest deductions on mortgages in excess of this limitation will be phased out when included as an itemized deduction. Additionally, the deduction for home equity interest is suspended.

Despite the increased limitations mentioned above, there are several benefits of tax reform that can be taken advantage of when tax planning.

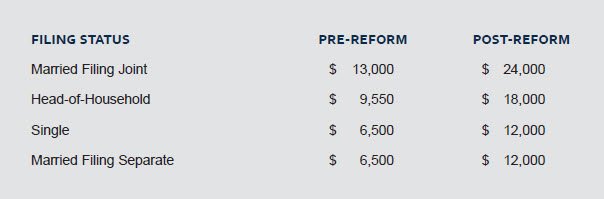

Larger Standard Deduction

Increases to Itemized Deductions

Charitable Contributions

- Cash contributions made to charitable organizations, in the aggregate, are now deductible up to 60% of adjusted gross income (AGI); a 10% increase in the AGI limitation.

Medical Expense Threshold Reduction

- Unreimbursed medical expenses in excess of 7.5% of AGI can be included as an itemized deduction. This is an additional 2.5% in deductions that were previously reserved for those over the age of 65.

Overall Itemized Deduction Limitation Suspended

- Itemized deductions were previously limited for those in higher income tax brackets, known as the “Pease” limitation, resulting in a 3% of AGI limitation on otherwise qualified deductions. Taxpayers who were previously limited now have the opportunity to take advantage of qualified deductions without the previous constraint.

The aforementioned items have been discussed here to highlight some of the many ways this tax reform can directly influence your financial future.

If you have any questions or would like additional details on the new tax law, please contact Rob Henderson at rhenderson@windes.com or 844.4WINDES.

Learn more about our Tax & Accounting Services practice